Edvest Maximum Contribution 2025. The maximum contribution deduction for the 2025 tax year is: In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor.

One of the most unique features of your edvest 529 account is the capability to ask for help from friends and family. In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor.

For example, here’s a look at the maximum contribution limits for iras and 401(k) plans for both 2025 and 2025:

2025 Contribution Limits Announced by the IRS, Here’s a look at 529 contribution limits for. One of the most unique features of your edvest 529 account is the capability to ask for help from friends and family.

What’s the Maximum 401k Contribution Limit in 2025? (2025), $22,500 in 2025, $23,000 in 2025;. Send them a ugift ® invitation for a special occasion, like a.

401k 2025 contribution limit chart Choosing Your Gold IRA, 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary. Send them a ugift ® invitation for a special occasion, like a.

Significant HSA Contribution Limit Increase for 2025, Or $2,500 per beneficiary for a married couple filing separately. Wisconsin offers a state tax deduction for contributions to a 529 plan in 2025 of up to $4,000 per beneficiary ($2,000 for married filing separate status and divorced parents of a.

401k Catch Up Contribution Limits 2025 Over 50 Kenna Alameda, Or $2,500 per beneficiary for a married couple filing separately. 529 college savings plans do not have contribution deadlines.

2025 Tsp Maximum Contribution 2025 Calendar, For example, here’s a look at the maximum contribution limits for iras and 401(k) plans for both 2025 and 2025: Compared to those of other states, however, wisconsin’s 529 plans offer a high maximum contribution of $516,000.

401k 2025 Contribution Limit Chart, For 2025, the maximum annual subtraction for contributions to a wisconsin college savings account is. They range from $235,000 to upward of $500,000.

415 Contribution Limits 2025 Perry Brigitta, Or $2,500 per beneficiary for a married. Read and consider it carefully before investing.

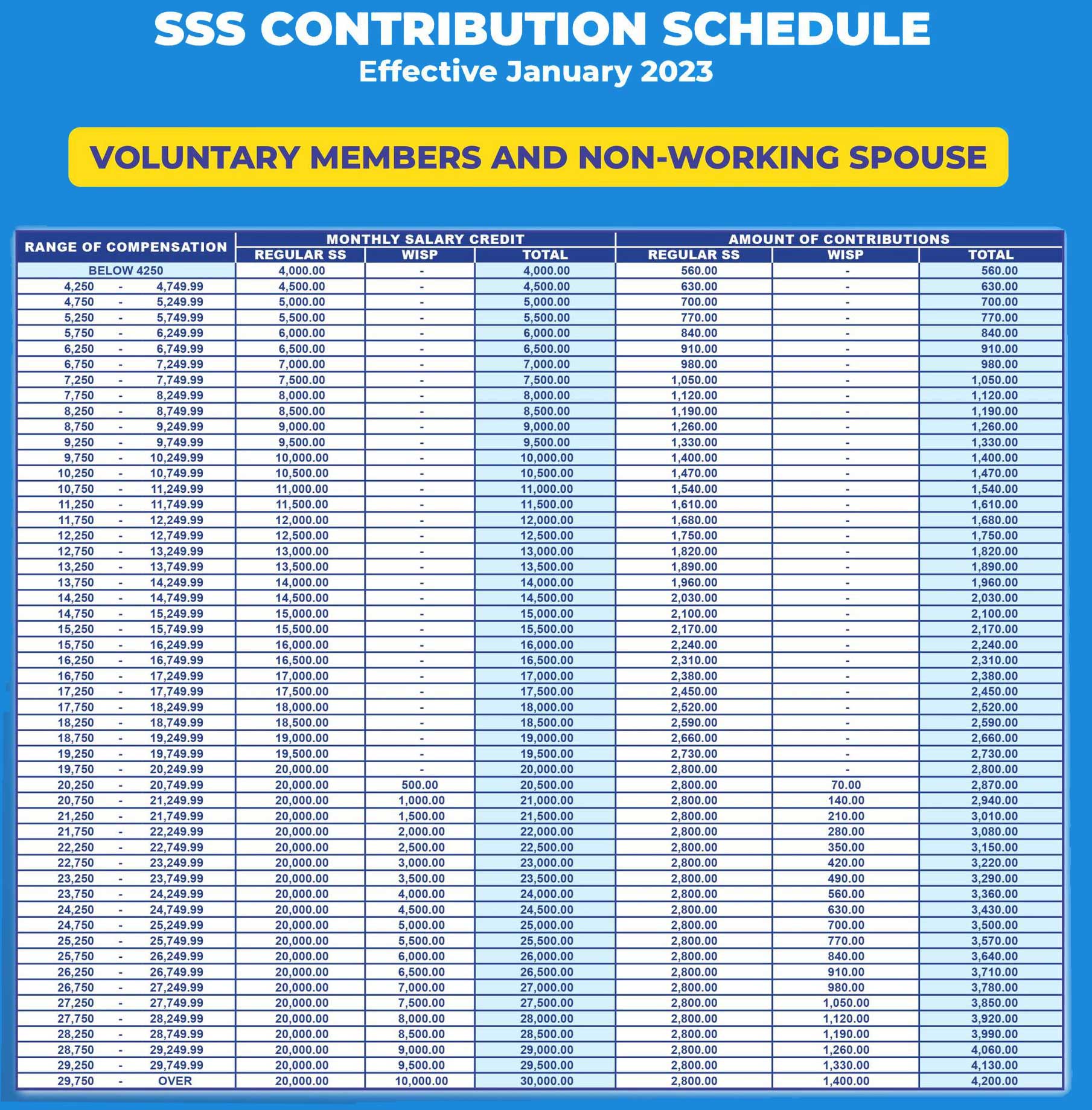

SSS Voluntary Members Contribution Table 2025, Wisconsin's maximum 529 plan contribution limit is $567,500 as the sum of all wisconsin plan accounts for the same beneficiary (i.e.,. For example, here’s a look at the maximum contribution limits for iras and 401(k) plans for both 2025 and 2025:

Maximum Defined Contribution 2025 Sandy Cornelia, 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary. Send them a ugift ® invitation for a special occasion, like a.