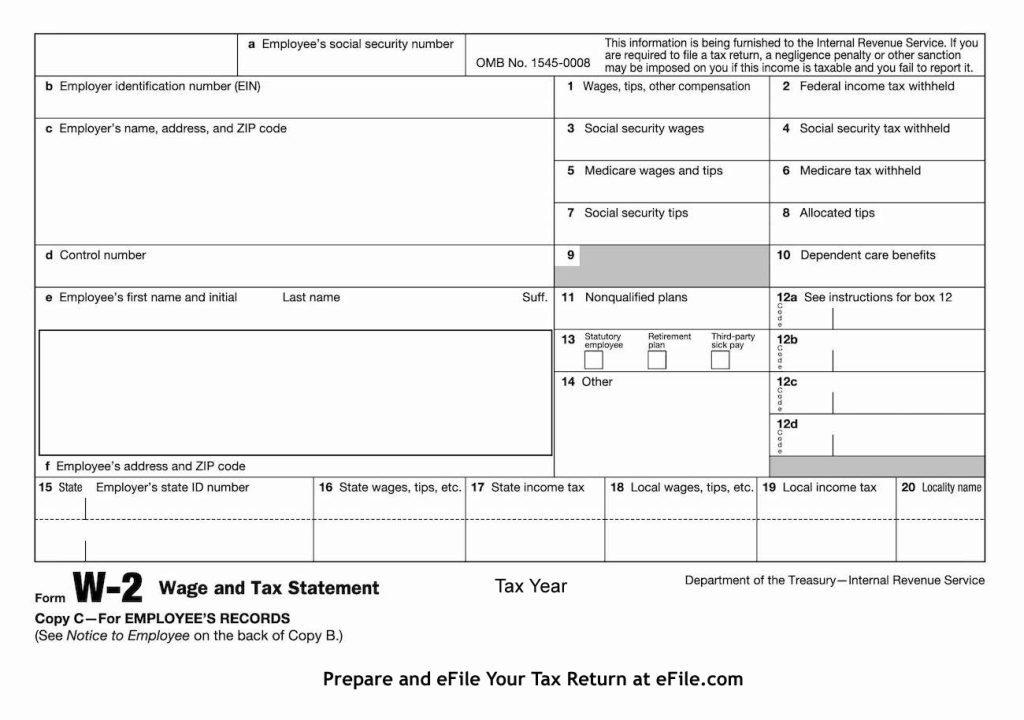

W2 Form 2025 For Employee To Fill Out. The key forms to know when you file taxes in 2025. If you’re a small business owner with employees, you know the importance of filing and paying your payroll taxes.

The key forms to know when you file taxes in 2025. If you’re a small business owner with employees, you know the importance of filing and paying your payroll taxes.

Mn W2 Form Printable, 1.1k views 9 months ago tax forms filling tips. Streamline the process and ensure accuracy by following.

Free Printable W2 Form 2025 Printable Forms Free Online, Employers use the information on a w. It tells the irs how much the employee earned and the amount of federal income taxes.

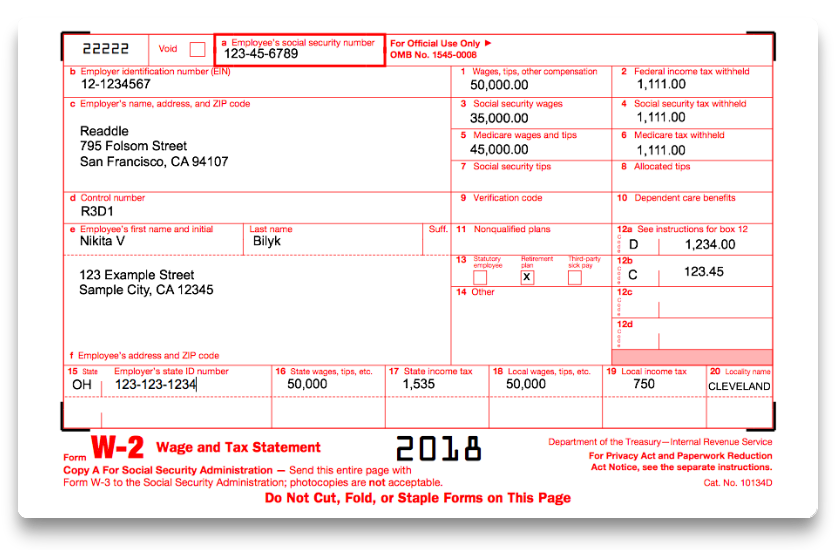

W2 Form 2025 Example Printable Forms Free Online, 1.1k views 9 months ago tax forms filling tips. Actual wage and salary amount;.

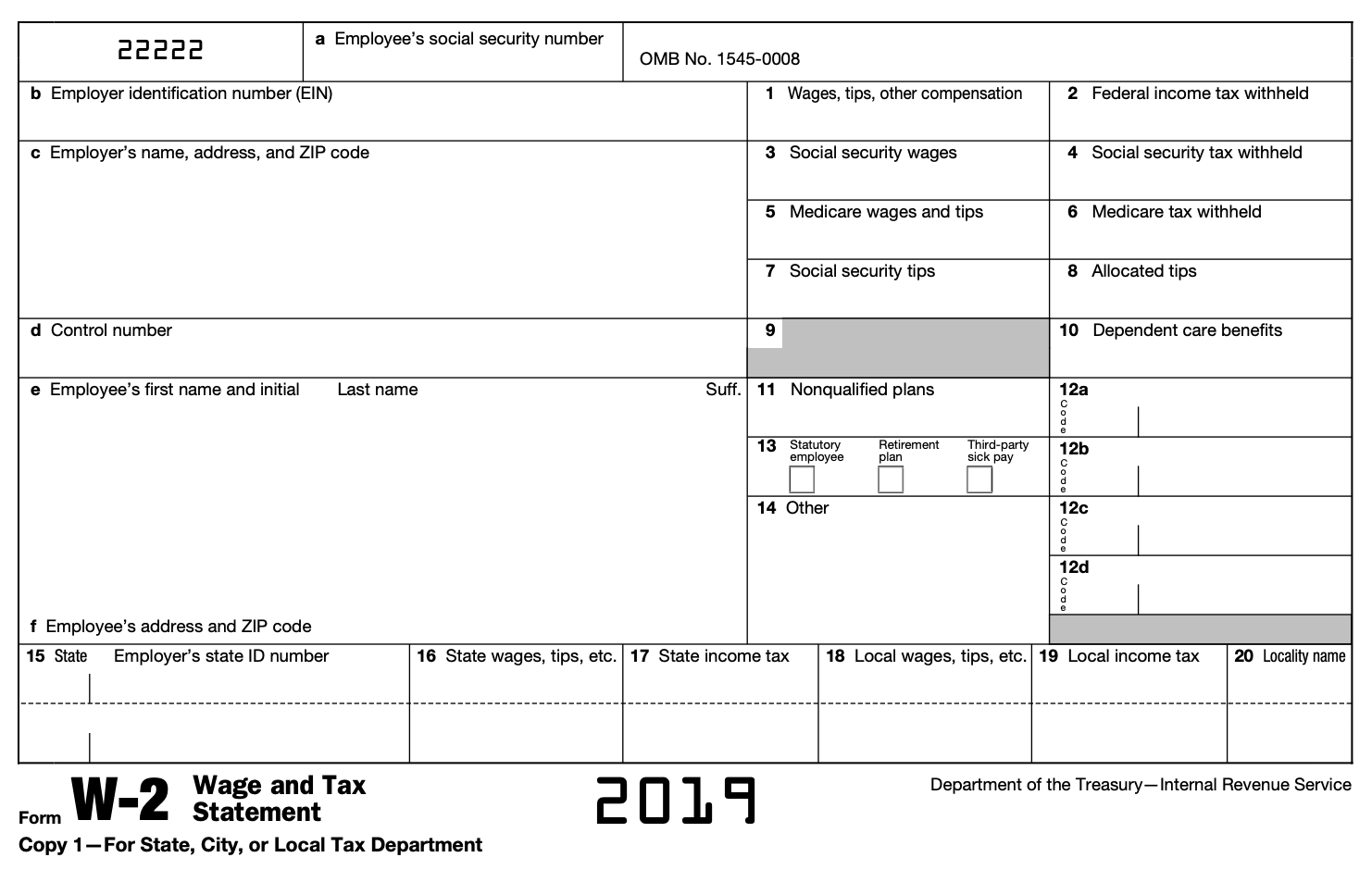

Free Printable W 10 Form Printable Forms Free Online, The key forms to know when you file taxes in 2025. Copy 2 for the employee to file with their individual state, city, or local tax return.

W2 Form 2025 Brit Marney, Actual wage and salary amount;. Copy 2 for the employee to file with their individual state, city, or local tax return.

How To Get My 2025 W2 Online Ibby Theadora, You can ignore this box. Tax day is approaching, and it will soon be time to begin assembling.

How to fill out IRS Form W2 20172018 PDF Expert, How to read it and when to expect it. Actual wage and salary amount;.

What Year W2 Do I Need For 2025 Taxes Deina Alexandra, If you’re a small business owner with employees, you know the importance of filing and paying your payroll taxes. It tells the irs how much the employee earned and the amount of federal income taxes.

Get W9 Form 2025 Print Calendar Printables Free Blank, Application for tentative refund of withholding on 2025 sales of real property by nonresidents. You can ignore this box.

W2 Form 2025 Fillable Pdf Printable Forms Free Online, Employees use it to report payroll taxes paid, and the irs uses it to determine how much is owed in taxes, if any, or if employees are due a refund. It has only five steps.

If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to.